[好文分享:www.11jj.com]

[本文来自:www.11jj.com]

YouTube网红小哥Siraj Raval系列视频又和大家见面啦!今天要讲的是加密货币价格预测,包含大量代码,还用一个视频详解具体步骤,不信你看了还学不会!

点击观看详解视频

时长22分钟

有中文字幕

▼

预测加密货币价格其实很简单,用Python+Keras,再来一个循环神经网络(确切说是双向LSTM),只需要9步就可以了!..以太坊价格预测都不在话下。

这9个步骤是:

数据处理

建模

训练模型

测试模型

分析价格变化

分析价格百分比变化

比较预测值和实际数据

计算模型评估指标

结合在一起:可视化

数据处理

导入Keras、Scikit learn的metrics、numpy、pandas、matplotlib这些我们需要的库。

## Keras for deep learningfrom keras.layers.core

import Dense, Activation, Dropout

from keras.layers.recurrent

import LSTM

from keras.layers

import Bidirectional

from keras.models

import Sequential

## Scikit learn for mapping metricsfrom sklearn.metrics

import mean_squared_error

#for loggingimport time

##matrix mathimport numpy as np

import math

##plottingimport matplotlib.pyplot as plt

##data processingimport pandas as pd

首先,要对数据进行归一化处理。关于数据处理的原则,有张大图,大家可以在大数据文摘公众号后台对话框内回复“加密货币”查看高清图。

def load_data(filename, sequence_length):

"""

Loads the bitcoin data

Arguments:

filename -- A string that represents where the .csv file can be located

sequence_length -- An integer of how many days should be looked at in a row

Returns:

X_train -- A tensor of shape (2400, 49, 35) that will be inputed into the model to train it

Y_train -- A tensor of shape (2400,) that will be inputed into the model to train it

X_test -- A tensor of shape (267, 49, 35) that will be used to test the model"s proficiency

Y_test -- A tensor of shape (267,) that will be used to check the model"s predictions

Y_daybefore -- A tensor of shape (267,) that represents the price of bitcoin the day before each Y_test value

unnormalized_bases -- A tensor of shape (267,) that will be used to get the true prices from the normalized ones

window_size -- An integer that represents how many days of X values the model can look at at once

"""

#Read the data file

raw_data = pd.read_csv(filename, dtype =

float).values

#Change all zeros to the number before the zero occurs

for x in range(0, raw_data.shape[0]):

for y in range(0, raw_data.shape[1]):

if(raw_data[x][y] == 0):

raw_data[x][y] = raw_data[x

-1][y]

#Convert the file to a list data = raw_data.tolist()

#Convert the data to a 3D array (a x b x c)

#Where a is the number of days, b is the window size, and c is the number of features in the data file

result = [] for index in range(len(data) - sequence_length):

result.append(data[index: index + sequence_length])

#Normalizing data by going through each window

#Every value in the window is divided by the first value in the window, and then 1 is subtracted

d0 = np.array(result)

dr = np.zeros_like(d0)

dr[:,

1:,:] = d0[:,

1:,:] / d0[:,

0:

1,:] -

1 #Keeping the unnormalized prices for Y_test

#Useful when graphing bitcoin price over time later start =

2400 end =

int(dr.shape[

0] +

1)

unnormalized_bases = d0[start:end,

0:

1,

20]

#Splitting data set into training (First 90% of data points) and testing data (last 10% of data points) split_line = round(

0.9 * dr.shape[

0])

training_data = dr[:

int(split_line), :]

#Shuffle the data np.random.shuffle(training_data)

#Training Data X_train = training_data[:, :

-1]

Y_train = training_data[:,

-1]

Y_train = Y_train[:,

20]

#Testing data X_test = dr[

int(split_line):, :

-1]

Y_test = dr[

int(split_line):,

49, :]

Y_test = Y_test[:,

20]

#Get the day before Y_test"s price Y_daybefore = dr[

int(split_line):,

48, :]

Y_daybefore = Y_daybefore[:,

20]

#Get window size and sequence length sequence_length = sequence_length

window_size = sequence_length -

1 #because the last value is reserved as the y value return X_train, Y_train, X_test, Y_test, Y_daybefore, unnormalized_bases, window_size

建模

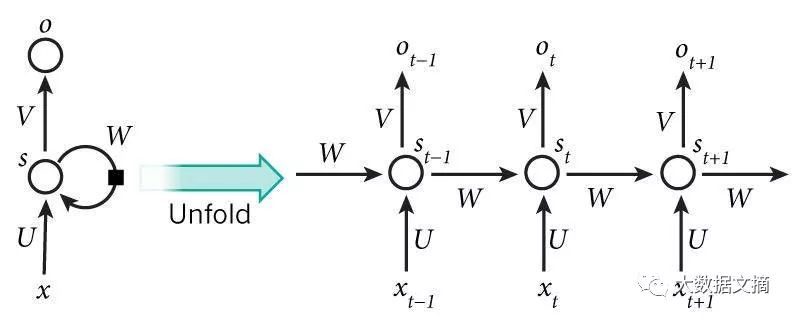

我们用到的是一个3层RNN,dropout率20%。

双向RNN基于这样的想法:时间t的输出不仅依赖于序列中的前一个元素,而且还可以取决于未来的元素。比如,要预测一个序列中缺失的单词,需要查看左侧和右侧的上下文。双向RNN是两个堆叠在一起的RNN,根据两个RNN的隐藏状态计算输出。

举个例子,这句话里缺失的单词gym要查看上下文才能知道(文摘菌:everyday?):

I go to the ( ) everyday to get fit.

def initialize_model(window_size, dropout_value, activation_function, loss_function, optimizer):

"""

Initializes and creates the model to be used

Arguments:

window_size -- An integer that represents how many days of X_values the model can look at at once

dropout_value -- A decimal representing how much dropout should be incorporated at each level, in this case 0.2

activation_function -- A string to define the activation_function, in this case it is linear

loss_function -- A string to define the loss function to be used, in the case it is mean squared error

optimizer -- A string to define the optimizer to be used, in the case it is adam

Returns:

model -- A 3 layer RNN with 100*dropout_value dropout in each layer that uses activation_function as its activation

function, loss_function as its loss function, and optimizer as its optimizer

"""

#Create a Sequential model using Keras

model = Sequential()

#First recurrent layer with dropout model.add(Bidirectional(LSTM(window_size, return_sequences=True), input_shape=(window_size, X_train.shape[

-1]),))

model.add(Dropout(dropout_value))

#Second recurrent layer with dropout model.add(Bidirectional(LSTM((window_size*

2), return_sequences=True)))

model.add(Dropout(dropout_value))

#Third recurrent layer model.add(Bidirectional(LSTM(window_size, return_sequences=False)))

#Output layer (returns the predicted value)

model.add(Dense(units=1))

#Set activation function

model.add(Activation(activation_function))

#Set loss function and optimizer

model.compile(loss=loss_function, optimizer=optimizer)

return model训练模型

这里取batch size = 1024,epoch times = 100。我们需要最小化均方误差MSE。

def fit_model(model, X_train, Y_train, batch_num, num_epoch, val_split):

"""

Fits the model to the training data

Arguments:

model -- The previously initalized 3 layer Recurrent Neural Network

X_train -- A tensor of shape (2400, 49, 35) that represents the x values of the training data

Y_train -- A tensor of shape (2400,) that represents the y values of the training data

batch_num -- An integer representing the batch size to be used, in this case 1024

num_epoch -- An integer defining the number of epochs to be run, in this case 100

val_split -- A decimal representing the proportion of training data to be used as validation data

Returns:

model -- The 3 layer Recurrent Neural Network that has been fitted to the training data

training_time -- An integer representing the amount of time (in seconds) that the model was training

"""

#Record the time the model starts training

start = time.time()

#Train the model on X_train and Y_train model.fit(X_train, Y_train, batch_size= batch_num, nb_epoch=num_epoch, validation_split= val_split)

#Get the time it took to train the model (in seconds)

training_time =

int(math.

floor(time.time() - start))

return model, training_time

测试模型

def test_model(model, X_test, Y_test, unnormalized_bases):

"""

Test the model on the testing data

Arguments:

model -- The previously fitted 3 layer Recurrent Neural Network

X_test -- A tensor of shape (267, 49, 35) that represents the x values of the testing data

Y_test -- A tensor of shape (267,) that represents the y values of the testing data

unnormalized_bases -- A tensor of shape (267,) that can be used to get unnormalized data points

Returns:

y_predict -- A tensor of shape (267,) that represnts the normalized values that the model predicts based on X_test

real_y_test -- A tensor of shape (267,) that represents the actual prices of bitcoin throughout the testing period

real_y_predict -- A tensor of shape (267,) that represents the model"s predicted prices of bitcoin

fig -- A branch of the graph of the real predicted prices of bitcoin versus the real prices of bitcoin

"""

#Test the model on X_Test

y_predict = model.predict(X_test)

#Create empty 2D arrays to store unnormalized values real_y_test = np.zeros_like(Y_test)

real_y_predict = np.zeros_like(y_predict)

#Fill the 2D arrays with the real value and the predicted value by reversing the normalization process for i in range(Y_test.shape[

0]):

y = Y_test[i]

predict = y_predict[i]

real_y_test[i] = (y+

1)*unnormalized_bases[i]

real_y_predict[i] = (predict+

1)*unnormalized_bases[i]

#Plot of the predicted prices versus the real prices fig = plt.figure(figsize=(

10,

5))

ax = fig.add_subplot(

111)

ax.set_title(

"Bitcoin Price Over Time")

plt.plot(real_y_predict, color =

"green", label =

"Predicted Price")

plt.plot(real_y_test, color =

"red", label =

"Real Price")

ax.set_ylabel(

"Price (USD)")

ax.set_xlabel(

"Time (Days)")

ax.legend()

return y_predict, real_y_test, real_y_predict, fig

分析价格变化

def price_change(Y_daybefore, Y_test, y_predict):

"""

Calculate the percent change between each value and the day before

Arguments:

Y_daybefore -- A tensor of shape (267,) that represents the prices of each day before each price in Y_test

Y_test -- A tensor of shape (267,) that represents the normalized y values of the testing data

y_predict -- A tensor of shape (267,) that represents the normalized y values of the model"s predictions

Returns:

Y_daybefore -- A tensor of shape (267, 1) that represents the prices of each day before each price in Y_test

Y_test -- A tensor of shape (267, 1) that represents the normalized y values of the testing data

delta_predict -- A tensor of shape (267, 1) that represents the difference between predicted and day before values

delta_real -- A tensor of shape (267, 1) that represents the difference between real and day before values

fig -- A plot representing percent change in bitcoin price per day,

"""

#Reshaping Y_daybefore and Y_test

Y_daybefore = np.reshape(Y_daybefore, (

-1,

1))

Y_test = np.reshape(Y_test, (

-1,

1))

#The difference between each predicted value and the value from the day before delta_predict = (y_predict - Y_daybefore) / (

1+Y_daybefore)

#The difference between each true value and the value from the day before delta_real = (Y_test - Y_daybefore) / (

1+Y_daybefore)

#Plotting the predicted percent change versus the real percent change fig = plt.figure(figsize=(

10,

6))

ax = fig.add_subplot(

111)

ax.set_title(

"Percent Change in Bitcoin Price Per Day")

plt.plot(delta_predict, color=

"green", label =

"Predicted Percent Change")

plt.plot(delta_real, color=

"red", label =

"Real Percent Change")

plt.ylabel(

"Percent Change")

plt.xlabel(

"Time (Days)")

ax.legend()

plt.show()

return Y_daybefore, Y_test, delta_predict, delta_real, fig

分析价格百分比变化

def binary_price(delta_predict, delta_real):

"""

Converts percent change to a binary 1 or 0, where 1 is an increase and 0 is a decrease/no change

Arguments:

delta_predict -- A tensor of shape (267, 1) that represents the predicted percent change in price

delta_real -- A tensor of shape (267, 1) that represents the real percent change in price

Returns:

delta_predict_1_0 -- A tensor of shape (267, 1) that represents the binary version of delta_predict

delta_real_1_0 -- A tensor of shape (267, 1) that represents the binary version of delta_real

"""

#Empty arrays where a 1 represents an increase in price and a 0 represents a decrease in price

delta_predict_1_0 = np.empty(delta_predict.shape)

delta_real_1_0 = np.empty(delta_real.shape)

#If the change in price is greater than zero, store it as a 1 #If the change in price is less than zero, store it as a 0 for i in range(delta_predict.shape[

0]):

if delta_predict[i][

0] >

0:

delta_predict_1_0[i][

0] =

1 else:

delta_predict_1_0[i][

0] =

0 for i in range(delta_real.shape[

0]):

if delta_real[i][

0] >

0:

delta_real_1_0[i][

0] =

1 else:

delta_real_1_0[i][

0] =

0 return delta_predict_1_0, delta_real_1_0

比较预测值和实际数据

def find_positives_negatives(delta_predict_1_0, delta_real_1_0):

"""

Finding the number of false positives, false negatives, true positives, true negatives

Arguments:

delta_predict_1_0 -- A tensor of shape (267, 1) that represents the binary version of delta_predict

delta_real_1_0 -- A tensor of shape (267, 1) that represents the binary version of delta_real

Returns:

true_pos -- An integer that represents the number of true positives achieved by the model

false_pos -- An integer that represents the number of false positives achieved by the model

true_neg -- An integer that represents the number of true negatives achieved by the model

false_neg -- An integer that represents the number of false negatives achieved by the model

"""

#Finding the number of false positive/negatives and true positives/negatives

true_pos = 0 false_pos =

0 true_neg =

0 false_neg =

0 for i in range(delta_real_1_0.shape[

0]):

real = delta_real_1_0[i][

0]

predicted = delta_predict_1_0[i][

0]

if real ==

1:

if predicted ==

1:

true_pos +=

1 else:

false_neg +=

1 elif real ==

0:

if predicted ==

0:

true_neg +=

1 else:

false_pos +=

1 return true_pos, false_pos, true_neg, false_neg

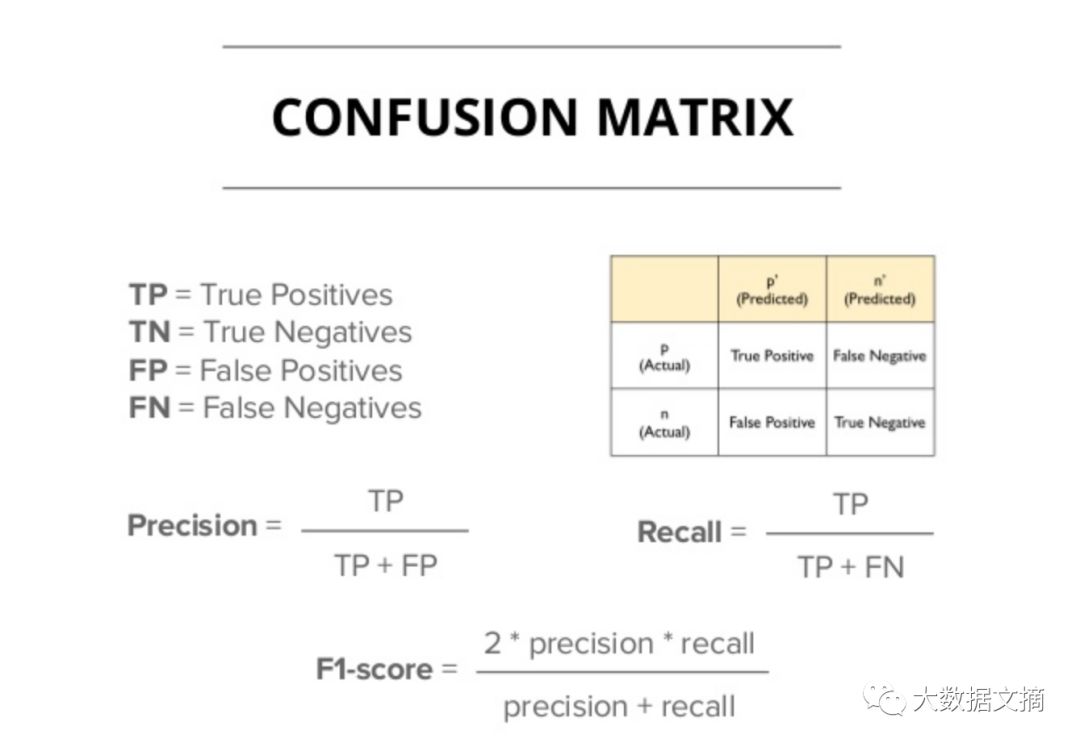

计算模型评估指标

def calculate_statistics(true_pos, false_pos, true_neg, false_neg, y_predict, Y_test):

"""

Calculate various statistics to assess performance

Arguments:

true_pos -- An integer that represents the number of true positives achieved by the model

false_pos -- An integer that represents the number of false positives achieved by the model

true_neg -- An integer that represents the number of true negatives achieved by the model

false_neg -- An integer that represents the number of false negatives achieved by the model

Y_test -- A tensor of shape (267, 1) that represents the normalized y values of the testing data

y_predict -- A tensor of shape (267, 1) that represents the normalized y values of the model"s predictions

Returns:

precision -- How often the model gets a true positive compared to how often it returns a positive

recall -- How often the model gets a true positive compared to how often is hould have gotten a positive

F1 -- The weighted average of recall and precision

Mean Squared Error -- The average of the squares of the differences between predicted and real values

"""

precision =

float(true_pos) / (true_pos + false_pos)

recall =

float(true_pos) / (true_pos + false_neg)

F1 =

float(

2 * precision * recall) / (precision + recall)

#Get Mean Squared Error MSE = mean_squared_error(y_predict.flatten(), Y_test.flatten())

return precision, recall, F1, MSE

结合在一起:可视化

终于可以看看我们的成果啦!

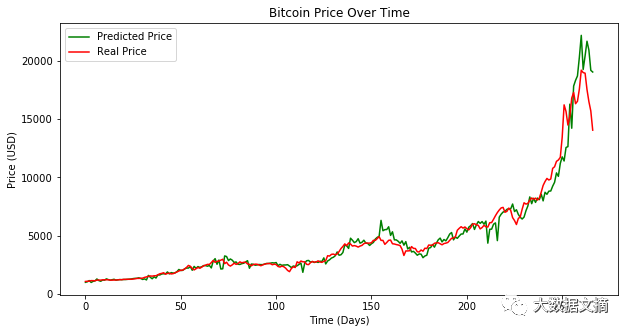

首先是预测价格vs实际价格:

y_predict, real_y_test, real_y_predict, fig1 = test_model(model, X_test, Y_test, unnormalized_bases)

#Show the plotplt.show(fig1)

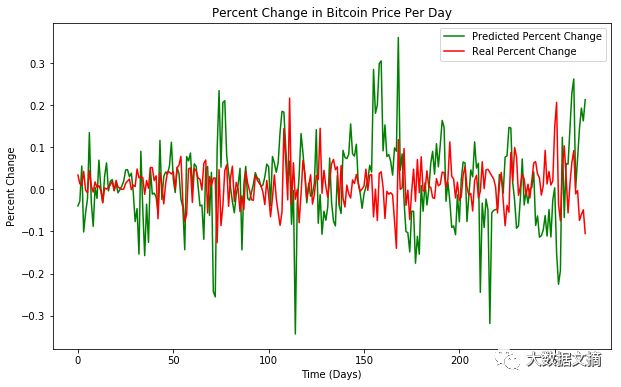

然后是预测的百分比变化vs实际的百分比变化,值得注意的是,这里的预测相对实际来说波动更大,这是模型可以提高的部分:

Y_daybefore, Y_test, delta_predict, delta_real, fig2 = price_change(Y_daybefore, Y_test, y_predict)

#Show the plot

plt.show(fig2)

最终模型表现是这样的:

Precision: 0.62

Recall: 0.553571428571

F1 score: 0.584905660377

Mean Squared Error: 0.0430756924477

怎么样,看完有没有跃跃欲试呢?

代码下载地址:

http://github.com/llSourcell/ethereum_future/blob/master/A%20Deep%20Learning%20Approach%20to%20Predicting%20Cryptocurrency%20Prices.ipynb

原视频地址:

http://www.youtube.com/watch?v=G5Mx7yYdEhE

作 者 | Siraj Raval 大数据文摘经授权译制

翻 译 | 糖竹子、狗小白、邓子稷

时间轴 | 韩振峰、Barbara、菜菜Tom

监 制 | 龙牧雪

【今日机器学习概念】

Have a Great Definition

志愿者介绍

回复“志愿者”加入我们